Acknowledgement Of Pan Application Form 49a

Permanent Account Number (PAN) is a 10 digit alphanumeric number issued by the Income Tax Department (ITD) in the form of a laminated card. Such a number enables the ITD to link all the transactions of the person with the department. These transactions of an individual or any other person (, Trusts etc ) may include:. tax payments. /TCS credits. income/wealth/gift/FTP returns. specific transactions.

any other correspondenceThus, PAN acts as an identity of a person or an individual with the ITD. PAN was introduced to support:. attaching payment of taxes, assessment, outstanding taxes, taxes to be paid etc relating to an assessee. easy recovery of information. matching of details pertaining to the investments, loans and other business. activities of the taxpayers. discover tax evasion etc.Hence, before understanding the procedure for online PAN card application, its first important to know who needs to apply for a PAN card.

The following persons need to obtain PAN:. Every person whose total income or the total income of any other person in respect of whom he is assessable during the year exceeds the maximum amount which is not chargeable to income tax. Person carrying on any business or profession whose total sales, turnover or gross receipts exceed or are likely to exceed Rs.

5 lakhs in any year. A charitable Trust who is required to furnish return under section 139 (4A). Any class or class of persons who are required to pay tax under income tax act or any other act for the time being in force. These persons also include importers or exporters whether they are required to pay any tax or not.

Persons notified by the central government for the purposes of collecting information useful or relevant to the purposes of this act. Any person who may or may not liable to pay tax under the act may be allotted PAN by the assessing officer.

He may issue PAN with regards to the nature of transactions as may be prescribed under the act. Also, any person who may request the assessing officer to allot PAN. Every person who intends to enter into specific financial transactions in which quoting of PAN is mandatory. The applicant who has never applied for PAN or has not been allotted a PAN needs to fill the application form for PAN. Before filling the application form he needs to check whether he has been allotted PAN or not. The applicant can do so by accessing the website of the ITD department i.e.

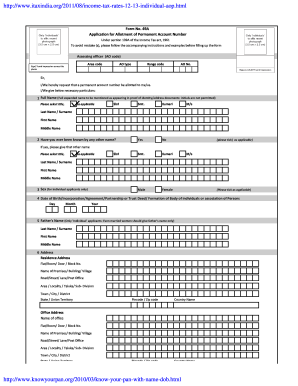

Thus, the ITD mentions the following forms with effect from November 1, 2011 to submit applications for the allotment of new PAN. Form 49A: This application form needs to be filled by Indian citizens including those located outside India. Form 49AA: This form needs to be filled by foreign citizens. Once the token number is received start filling the details in the form. Form 49A has around 15 section. It covers:.

Pan Card Download

personal details. details of parents. address. contact number and email id details.

status of applicant. source of income. registration number. aadhaar number.

details of the representative assessee. documents submitted as proof of identity, proof of address and proof of date of birth. acknowledgementHowever in form 49AA, apart from the above details, the application form for foreign citizens also contains KYC details section.The applicant must read the instructions carefully. He must not forget to fill the mandatory fields that are marked by an asterisk. If the data submitted by the applicant does not get validated due to format issues a response is displayed on the screen indicating the errors.

The applicant must rectify the errors and resubmit the form.However, if there are no errors the applicant’s screen displays message of confirmation. The applicant can either edit the details or confirm the same.

The applicant needs to mention that he wants the physical PAN card while submitting the PAN application form. Thus, printed copy of the physical PAN card would be sent to the communication address mentioned in the application form if the applicant chooses for physical PAN card. Further a pdf copy of an e – PAN card is also sent to the applicant at the email address specified in the application form.

Following is the fee structure in such a circumstance.PAN Applications Submitted Online Using Physical Mode (i.e. Physical documents sent to NSDL e – Gov. On confirmation of successful payment, an acknowledgement screen is displayed to the applicant. Such a screen displays a downloadable acknowledgement receipt.

Further, an email is sent to the applicant that contains the acknowledgement and payment receipts as attachments in pdf formats. This email is sent to the applicant on the email id mentioned in the application. The applicant must print this acknowledgement.

Huge Collection. Used by web developers. Used by apple for iphone etc.Helvetica fonts supports windows XP/7/8 & windows 10, This font is one of the best choice for professional graphics designing & web development Helvetica font family Samples:This font also used by mobile companies like apple for iphone & ipad, Helvetica font family is mostly used by graphics editors & web designers.  Helvetica Fonts For PC System Requirements: Operating SystemWindows XP, Windows 7, Windows Vista, Windows 8/10RAM256 MBHard Disk Space100 MBProcessor1000 MHZ / 1GHZCreate graphic designs & images for the websites or you can design a company logos. Easy to read.

Helvetica Fonts For PC System Requirements: Operating SystemWindows XP, Windows 7, Windows Vista, Windows 8/10RAM256 MBHard Disk Space100 MBProcessor1000 MHZ / 1GHZCreate graphic designs & images for the websites or you can design a company logos. Easy to read.

Further, if the applicant is an individual who is making an application for allotment of new PAN, he needs to affix two recent coloured passport size photograph. Also, he needs to put signatures or thumb impression across the photo on the left side of the acknowledgement.In case a non individual applicant submits PAN application, the authorized signatory on behalf of the applicant needs to sign the acknowledgement receipt. The applicant is required to send the requisite documents physically through courier or postal services at the below mentioned address of NSDL. These documents include duly signed acknowledgment, affixed with photographs (in case of ‘Individuals’) along with demand draft, if any, and proof of identity, proof of address and proof of date of birth.

This is the case where the applicant applies for PAN through physical mode. The address of NSDL is:. NSDL e-Gov at ‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016’.However, there is no need to send physical documents to NSDL e-Gov in case of e-KYC & e-Sign, e-Sign based or DSC based online PAN application.

This is because the PAN application is through paperless mode.Here is an infographic that explains in a simple way the PAN Card Application Procedure.